The European market potential for fresh blueberries

Blueberries in Europe have become popular as a healthy and easy-to-snack fruit. Consumers in the United Kingdom and Germany are especially fond of blueberries. Regional differences in consumption predicts further growth of blueberries throughout Europe. The growing demand is being met by an enormous increase in supply, so as a supplier it is important to monitor supply and demand carefully.

1. Product description

Blueberries are part of the genus Vaccinium. The main types of blueberries are highbush, lowbush, rabbiteye and half-high hybrid varieties. The most common blueberry for commercial cultivation is the (northern) highbush type. There are many varieties of blueberries each with their own characteristics in terms of size, growing season, flavour and cold hardiness.

Other berries that are found within the genus Vaccinium are cranberries, cowberries and bilberries, a European variety that is similar to the blueberry.

In this factsheet we will use the statistics of all the Vaccinium varieties. The main imported berries of this variety are blueberries, and it is possible that these are registered under different sub-codes.

Harmonized System (HS) code

08104000 Cranberries, bilberries and other fruit of the genus Vaccinium

Harmonized System (HS) code

- 08104050 Fresh fruit of species Vaccinium macrocarpum and Vaccinium corymbosum (American blueberry and cranberry)

- 08104030 Fresh fruit of species Vaccinium myrtillus (European blueberry or bilberry)

- 08104010 Cowberries, foxberries or mountain cranberries (fruit of the species Vaccinium vitis-idaea)

- 08104090 Other (possibly including blueberries among others)

Types of blueberries

- Northern highbush (Vaccinium corymbosum)

- Southern highbush (Vaccinium darrowii)

- Lowbush or wild blueberries (Vaccinium angustifolium)

- Rabbiteye (Vaccinium virgatum)

- half-high hybrids

Cultivars commercial varieties

Many different varieties are used depending on local climate and circumstances, early & late season coverage and characteristics.

2. What makes Europe an interesting market for blueberries?

Blueberries have been expanding fast in Europe and a growing supply will continue to push the consumption of blueberries. The unused potential makes Europe an interesting market, but you must be aware of market speculation and overproduction.

COVID-19 has had no negative effect on demand

Blueberries are a typical retail fruit in Europe and they also score well as a healthy snack. So the impact of the COVID-19 pandemic has been minimal. The main obstacle in the supply chain have been the lockdowns and the low availability of resources in the producing countries, mainly resulting in delays. As an exporter, if you are able to manage your production, packing and logistics well, you can continue to supply the European market.

Tip:

- Read the suggestions of British Columbia Blueberry Council on how to keep your business environment safe during the COVID-19 pandemic.

Blueberries still going strong in supply and demand

The European blueberry market has expanded rapidly over the past years. Both demand and supply are expected to continue to grow, although nobody knows its true potential. Suppliers can take advantage of the strong demand, but at the same time must count on prices slowly declining due to increasing availability of blueberries worldwide.

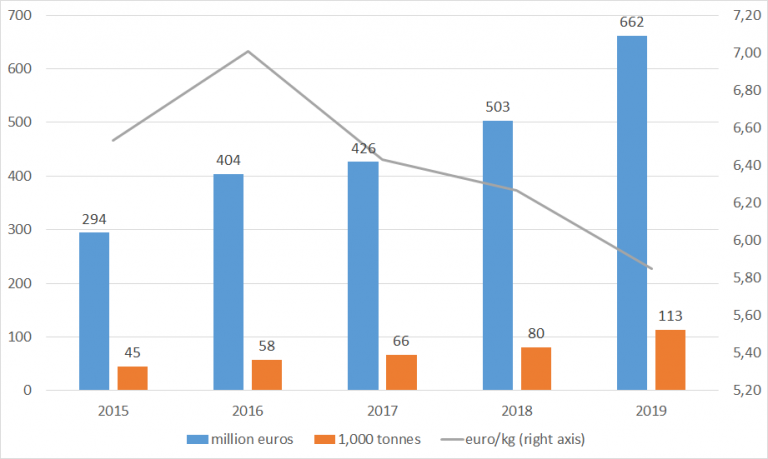

Europe’s import of blueberries has increased from 45,000 tonnes in 2015 to 113,000 tonnes in 2019. From 2018 to 2019 the import volume jumped by a whopping 41%. The supply side is looking for the boundaries of the European potential. Inevitably this has affected the product value. The average price trade price of blueberries has been in a downward trend since 2016.

Until now, the fast-expanding imports of blueberries into Europe could be contributed to the greater supply volumes from mainly Chile, Peru and Morocco. But new planting and production has been on the rise everywhere, counter-seasonal as well in and around Europe: in Spain and Poland, in the Ukraine, Serbia and Morocco and further away.

Despite the ever-increasing supply and lower average prices, Europe continues to import more blueberries every year. According to Rabobank’s reporting, there will be opportunities for value-added supplies and cost-competitive firms. Yet the demand for high quality is also increasing, so simply focusing on supplying commodity blueberries may not be enough.

Figure 1: European imports of fresh vaccinium berries (mainly blueberries)

Source: Eurostat / Market Access Database

Differences in consumption point to further expansion

Differences in consumption rates indicate that there is still a margin for further expansion in several European regions. But as a supplier it is important not to overestimate the market and secure your sales with steady buyers.

Global differences in consumption

Both on a global and European level there are large differences in blueberry consumption. A rough calculation based on production, import-export volumes and news sources points out that Europe is still far behind the United States and Canada (Table 1). Based on the current consumption estimates in the United States and Canada it is safe to assume that you will see the blueberry market expand further in Europe in the next several years.

European differences in consumption

Within Europe there are significant differences in consumption too. The United Kingdom leads the consumption in Europe with an estimated 0.8 kg per capita, which is more than double the European average. The International Blueberry Organization (IBO) notices strong demand in northern Europe such as the United Kingdom, but also sees great opportunities for growth in countries such as Spain, France and in the Eastern part of Europe.

Enthusiasm motivates the market

There is great enthusiasm for the European market and professionals see huge potential in blueberries when the demand throughout the region will match the higher consumption levels of the countries where blueberries are the most popular. However, the time that countries need to reach these levels is uncertain and the maximum potential can only be based on speculation.

Estimates vary, but according to the blueberry breeder Fall’s Creek it could be close to 860 g per person by 2026. This calculates to a total need of between 500,000 and 600,000 tonnes of blueberries. Based on current growth it is safe to assume that Europe can absorb an additional supply of 80,000 up to 150,000 tonnes from abroad five years from now, which is double the current demand. Global production volumes and retail promotions will determine how much blueberries will finally be sold in the market.

Table 1: Estimates of annual consumption per capita

Tips:

- Stay up to date with market developments by subscribing to newsletters and following market updates from Freshplaza, Fruitnet, the International Blueberry Organization and FreshFruitPortal or other news sites.

- Participate in international berry congresses to get better insights into the blueberry industry, for example the Global Berry Congress or the International Blueberry Organization’s (IBO) Summit.

- Make sure to have excellent commercial connections for your product before investing in blueberries. In Europe you can find and meet potential partners and buyers on the Fruit Logistica trade fair. Think twice when starting new plantations. The increasing volumes make the market nervous, so it is better to focus on existing orchards or varietal renewal.

- Read about how to do business with European buyers on the CBI market intelligence platform.

3. Which European countries offer most opportunities for blueberries?

Germany and the United Kingdom are the leading markets for blueberries, although the United Kingdom is closest to reaching maturity. A large and increasing part of the European supply is traded (and packed) in the Netherlands. Local production can also be a motivation to increase imports outside of the local season, which can be seen in Spain and Poland. In other parts of Europe, including France and Eastern Europe, there is untapped potential for blueberries.

Table 2: Blueberry production in Europe in 1000 tonnes

European Union – 28 countries

The Netherlands: a good place for the distribution of blueberries

The Netherlands became the largest importer of blueberries in 2019, although most were distributed outside the country. It is an important market when you are looking for an easy way to supply several European markets.

The Dutch market has grown together with the increasing European demand. With 69,000 tonnes of imported blueberries in 2019 (see Figure 2) and another 11,000 tonnes from its national production (see Table 2), the Netherlands was able to supply European clients with 55,000 tonnes. Although most were re-exported to Germany; note that Belgium, United Kingdom, Poland and Scandinavia are important destinations to reach via the Netherlands as well. The rest was absorbed by the Dutch consumption or processing industry.

Among Dutch consumers blueberries have become the most popular soft fruit after strawberries, which are being produced locally on a large scale. The Dutch market for blueberries relies more on imports, but is equally price competitive. Supermarkets offer attractive blueberry promotions to their customers and have increased their sales with 350% between 2013 and 2017.

Competition from Dutch growers is expected to increase between July and mid-September, as growers are stretching their seasons with different varieties and cooperative structures, trying to compensate for their high production costs. Nevertheless, the Netherlands will remain an important re-exporter of blueberries throughout most of the year.

Tip:

- Make use of Dutch traders when you have difficulties in entering different European markets – find a selection of importers on the website of the fruit and vegetable association Groentenfruithuis. Dutch importers often have wide experience in trading and are familiar with the different European preferences. Dutch fruit companies have a no-nonsense mentality, so calling or visiting them often works better than e-mailing.

Germany: most potential for blueberry consumption growth

With its high and fast-growing volume, Germany is the country with the most potential for blueberries in Europe at the moment, but requirements can be strict. Suppliers that are price competitive and able to deal with the required quality standards can find an attractive market in Germany.

Last year (2019) Germany overtook the United Kingdom in import volume. Germany’s blueberry imports increased from 19,000 tonnes in 2015 to 61,000 tonnes in 2019. German growers added another 15,000 tonnes to the imports. And Germany is also the main destination for frozen berries, with a 17% share in Europe.

Most blueberries come from Spain (almost 22,000 tonnes) and Germany itself. Retailers prefer to source blueberries from nearby with the guarantee of a clean and sustainable production. Locally produced blueberries are often organic certified. But Germany is also a price-conscious market and this makes buyers shift to more economic sources when available, such as Morocco. In the off-season Peru and Chile (often shipped through the Netherlands) take over most of the supply.

Tip:

- Expect to put extra effort into product documentation and certification (GlobalGAP, IFS, organic) to supply the German market. You can best focus on clean and cheap or adding extra value by supplying organic blueberries.

United Kingdom: market leader in blueberry consumption

The United Kingdom is market leader in blueberry consumption. For both European and non-European suppliers it is the largest market, but the maturing demand and price pressure may slow down future growth compared to other European countries.

Berries, including blueberries, have the biggest share in the fruit production of the United Kingdom. But campaigns such as Love Fresh Berries promote berries year-round. Blueberries are relatively new but they have become very popular as a superfood, as snack fruit and as an ingredient, for example in porridge, drinks and muffins. They are available in packages of multiple sizes.

Despite publications saying local UK blueberry production has increased from a few hundred tonnes in 2008 to 2,700 tonnes in 2018, consumption is mainly driven by the large import volume. Because blueberries are not a traditional berry for British growers, they are popular all year round and supplied by a large number of countries.

In 2019 the United Kingdom imported 57,000 tonnes of berries of the genus Vaccinium, or blueberries. Together with the national production the average annual consumption reached an estimated 0.8 kg per capita. This makes it the largest, but also one of the most mature markets for blueberries in Europe.

Future growth of the British market will depend on the extent to which blueberries can be promoted. Pressure on the profit margins due to Brexit-related inflation could make consumers resort to more affordable fruit or cheaper frozen blueberries.

Spain: offering opportunities for Moroccan suppliers

In Spain future growth can be expected, if not through local production then by increasing import volumes. But Spanish blueberry suppliers stay close to their own season. Therefore opportunities are not limited to a counter-seasonal supply. Instead, Spain imports most from Morocco to complement its local production.

In consumption Spain is still underdeveloped compared with most northern-European markets. Despite the limited consumption, Spain has grown to become the largest producer and the fourth-largest importer of blueberries. Most blueberries are destined for other markets, in particular Germany and the United Kingdom – the two largest blueberry consuming countries. With a total export volume of 67,000 tonnes Spain is Europe’s principal source for blueberries.

Spain is mainly focused on a seasonal supply with a peak from April until June. During this period Spain exports most of its production but also imports blueberries from Morocco, a country which is responsible for 72% of Spain’s import volume of 21,000 tonnes. The local production continued to grow to 53,000 tonnes in 2019. The concentrated period of a strong supply from Spain, Morocco and Portugal has had a negative effect on recent prices in 2019. Nevertheless, supermarket prices in Spain remained very high.

Some of the Spanish companies have extended their season and improved their competitiveness by integrating with growers or investing in cultivation projects in Morocco.

Tip:

- Visit theFruit Attractionfair to find blueberry alliances. This is especially useful if you can complement Spanish blueberry production.

France: slow, but steady growth

Blueberry demand in France is developing slower than one might expect, but the current consumption rate leaves room for further expansion. For off-season suppliers it can take longer to set foot on this typical and seasonal market.

France has the third-largest population in Europe and is therefore among the main markets for blueberries. However, the consumption has emerged much slower than in Germany and the United Kingdom. The reason for this is most likely the preference for local fruit that French farmers produce themselves, such as stone fruit and raspberries, but also European blueberries (bilberries). French consumers make a strong distinction between wild and cultivated blueberries.

Just as in Spain and Italy, French consumption is still low, but professionals anticipate a continuous and steady growth in these conservative markets. And with reason; French imports in 2019 were 2½ times higher than five years earlier.

With an production of 9,000 tonnes (similar to the volume in the Netherlands, although not recorded by Eurostat) France will not be able to cover future growth. Spain and Morocco have already stepped into this gap, becoming France’s main suppliers. Volumes from Peru and Portugal are also gradually rising. Currently, Spain is responsible for half of the 13,000 tonnes of imported blueberries in 2019. France will continue to depend on these external suppliers, firstly in-season and eventually also off-season.

Poland: blueberries are an important crop

With a strong production of more than 35,000 tonnes, blueberries have become an important crop in Poland and are nowadays locally considered to be Polish berries.

Exports (nearly 19,000 tonnes) exceed Polish imports (12,000 tonnes). But blueberries are imported year-round. This is a good sign that Polish consumers are developing a taste for blueberries also outside their local season. Spain and Morocco supply Poland just before the local season starts and the off-season demand is mainly supplied by trade through the Netherlands and Germany.

Consumption is increasing and price is an important motivation for Polish consumers to purchase blueberries. The average value per traded kilo was just under 5 euros in 2019, while most countries paid close to 6 euros. This means that price-competitive countries are best aligned to get their blueberries into Poland when local availability is low.

Tip:

- Focus on price-competitive blueberries when Poland is your final market. If you want to supply Poland directly you can find many blueberry professionals at the International Blueberry Conference, held in Poland. Have in mind that English is not yet a common language for business in Poland.

4. Which trends offer opportunities on the European blueberry market?

Consumer interest in easy and healthy snacks is one of the main success factors for blueberries. On top of that, strong promotion and product availability will further boost the market. However, clean and fresh blueberries from local sources are preferred.

Health leads to clean and sustainable blueberries

Consumers in Europe are becoming more aware of a healthy diet. The fast growth of blueberries can be attributed for a large part to consumers who are looking for healthy foods. This is why it is extra important to meet the consumer expectation of supplying a clean, sustainable and pesticide-free product.

Blueberries are known to contain high quantities of vitamin C and dietary fibre. It is important to understand the impact and the promotional value of the health benefits of blueberries. Today you can find blueberries in all kinds of foodstuffs, in which they are used to add value with their healthy image.

New product launches that use blueberries as a healthy ingredient strengthen the image of blueberries. But such products also include important claims such as additives/preservatives free, environmentally friendly packaging and organic. A company that took organic seriously is KingBerry in Argentina, which even obtained a biodynamic certification that allows them to be part of a very specific market. There are also developments in the packaging that make blueberries a better choice, for example the 100% recyclable punnets in the British ASDA supermarkets.

Tips:

- Find ways to reduce pesticides by using natural or integrated pest management (IPM). Check in your country if there are guidelines for pest management, similar to Blueberry IPM Manual of Northwest Washington.

- Only start with organic production if local circumstances allow for it. For example, hydroponic cultivation is not permitted for organic certification in Europe.

Blueberries respond to the interest in snack fruit and easy ingredients

The European consumer has an increasing preference for fruit that is easy to consume or easy to use. This means your product is likely to be consumer packed. When packing at point of origin, make sure your packaging is suitable and attractive for the European consumer.

Blueberries can be packed in different sizes and are an excellent option for consumers as a snack. Snack packages are especially popular among retailers in north-western Europe, such as in Germany, the Netherlands and the United Kingdom.

Blueberries are also a well appreciated ingredient in yoghurts, cereals, sweet pastry or fruit shakes and salads. Both fresh and frozen blueberries are used as an ingredient.

Image 1: Example of attractive packaging by Angus Soft Fruits

Image 2: Example of wholesale packaging at the Rungis market in Paris

Tip:

- Offer different packaging options and sizes to your buyers. Also take sustainability into account and try to reduce plastic: for example provide top seal closures instead of lids.

Promotion and production continue to develop markets

Production and product promotion have become essential factors for the current consumption growth. When investing in blueberry production, you must be aware of the risks and volatility in supply and demand.

The blueberry industry and promotional organisations such as the International Blueberry Organization, Fruits from Chile and the U.S. Highbush Blueberry Council continue to promote blueberries to boost consumption. Subsequently worldwide suppliers attempt to meet the growing demand by increasing their production capacity. This has resulted in many new production projects and plantings all over the world.

It is the dynamic of promotion and production that keep markets developing further. And although industry sources still see opportunities to continue developing the blueberry market, nobody knows how far this can be stretched.

Preference for local seasonal products

There is a growing preference for local produce. When products are available from local sources, you will have more difficulties to put your product to market unless you have a significant competitive advantage, for example in price or a superior variety.

Consumers are becoming more conscious about seasonality and there is a common notion that fruit from local growers is more sustainable. Thanks to advancing storage technologies and different blueberry varieties, European producers will also be able to extend their season. The extended seasons and the preference for local products can pose a risk for the future import from external suppliers.

Currently a significant part of berry demand is still met by imports. In the long-term Europe can become more self-sufficient during their main production period. As a non-European supplier your best chances are during the off-season periods.

Tips:

- Diversify your markets so you can optimise profit during your specific supply season.

- Read the CBITrendsin fresh fruit and vegetables to get more insights into fresh trends that can benefit your growth.